Consulting Articles > Consulting Case Interviews > Breakeven Analysis in Case Interviews: Complete Preparation Guide

Breakeven analysis is one of the most common financial concepts tested in consulting interviews, especially when solving profitability or pricing problems. In simple terms, it identifies the point where revenue equals costs, no profit, no loss, making it essential for evaluating business performance in a break even case study or real-world scenario. For aspiring consultants, mastering this skill shows clear financial judgment and structured problem-solving. In this article, we will explore what breakeven analysis is, walk through a practical breakeven analysis example, and explain how to apply it effectively in case interviews.

What Is Breakeven Analysis Example in Case Interviews?

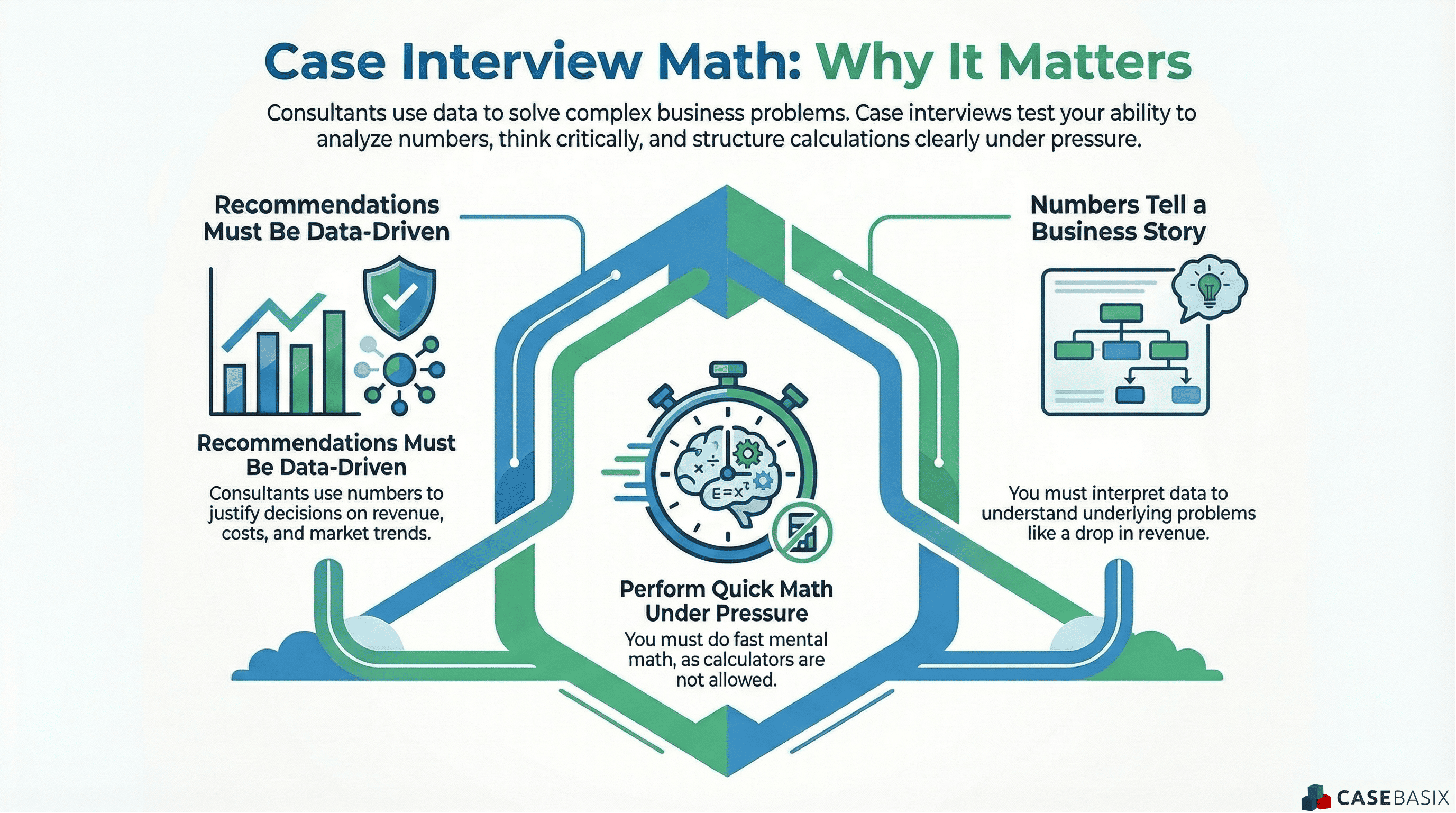

This infographic shows why strong math skills help you interpret data and reach clear conclusions during case interviews.

Case interviews rely heavily on clear numerical reasoning, making math a central part of evaluating business problems. Understanding how data supports recommendations helps you analyze breakeven points with more confidence. Quick and structured calculations also allow you to interpret trends and solve problems under pressure.

Breakeven analysis is a simple yet essential financial tool that helps businesses figure out the point at which their total costs – both fixed and variable – are equal to their total revenue. It’s that moment when a business isn’t losing money, but isn’t making a profit either. Knowing when you’ve reached this point is crucial for making smart business decisions.

Definition and Significance

Think of breakeven analysis as a financial checkpoint. It tells you how many units you need to sell just to cover your costs. Anything beyond that is profit. In the real world, businesses use breakeven analysis to:

- Assess the risk of launching a new product or entering a new market

- Set realistic sales targets

- Adjust pricing or cost structures to boost profitability

For example, imagine you're planning to launch a new product. By calculating the breakeven point, you can determine how many units you need to sell to start making a profit. Without this insight, you might end up overestimating sales or underpricing your product, both of which could lead to financial losses.

Role in Case Interviews

Now, let’s bring this into the context of case interviews. As a consultant, you’ll often be asked to evaluate business decisions, like whether to introduce a new product, enter a new market, or adjust pricing. Breakeven analysis is an excellent way to measure the financial feasibility of these strategies.

When faced with such a scenario in an interview, you’ll use breakeven analysis to answer questions like:

- How many units need to be sold to cover costs?

- Will this strategy lead to profit, or is it too risky?

- What are the financial implications if costs rise or sales fall short?

Being able to walk through these calculations and explain your reasoning shows that you can think critically about the financial side of business decisions. It’s a great way to demonstrate your analytical skills and make a strong impression during your case interview.

What Are the Key Components of Breakeven Analysis Explanation?

To calculate the breakeven point, you need to understand the key components of breakeven analysis: fixed costs, variable costs, and selling price per unit. These elements work together to help you figure out how much a business needs to sell before it starts turning a profit.

Fixed Costs

Fixed costs are the expenses that stay the same no matter how much you produce or sell. Even if you don’t produce a single unit, these costs will still exist. Think of them as the foundation of your business’s cost structure. Some examples include:

- Rent for your office or manufacturing space

- Salaries for full-time employees

- Insurance premiums

- Depreciation of equipment

In your case interview, identifying these costs accurately is crucial because they need to be covered before you can start making any profit. It’s like the “base” amount of money you need to cover before everything else kicks in.

Variable Costs

Variable costs, on the other hand, change depending on how much you produce or sell. The more units you make, the higher these costs become. Here’s what variable costs look like:

- Raw materials used to make your product

- Direct labor costs tied to production

- Shipping and distribution costs

Understanding these costs is key because they scale with production. In a case interview, this will help you assess how flexible and scalable a business model is – and how much the breakeven point might shift based on production changes.

Selling Price per Unit

The selling price per unit is the price at which you sell your product or service. This is a game-changer when it comes to profitability. A higher selling price means you need to sell fewer units to cover your costs and start making a profit. However, if your price is too low, you might find yourself selling a lot more just to reach the breakeven point.

For example, if your product costs $10 with $3 in variable costs and $1,000 in fixed costs, you would need to sell 200 units to break even. But if you increase the price to $15, you’ll need fewer units to cover those costs. This shows how powerful pricing decisions can be for the health of a business.

How to Calculate Breakeven Analysis Example in Case Interviews

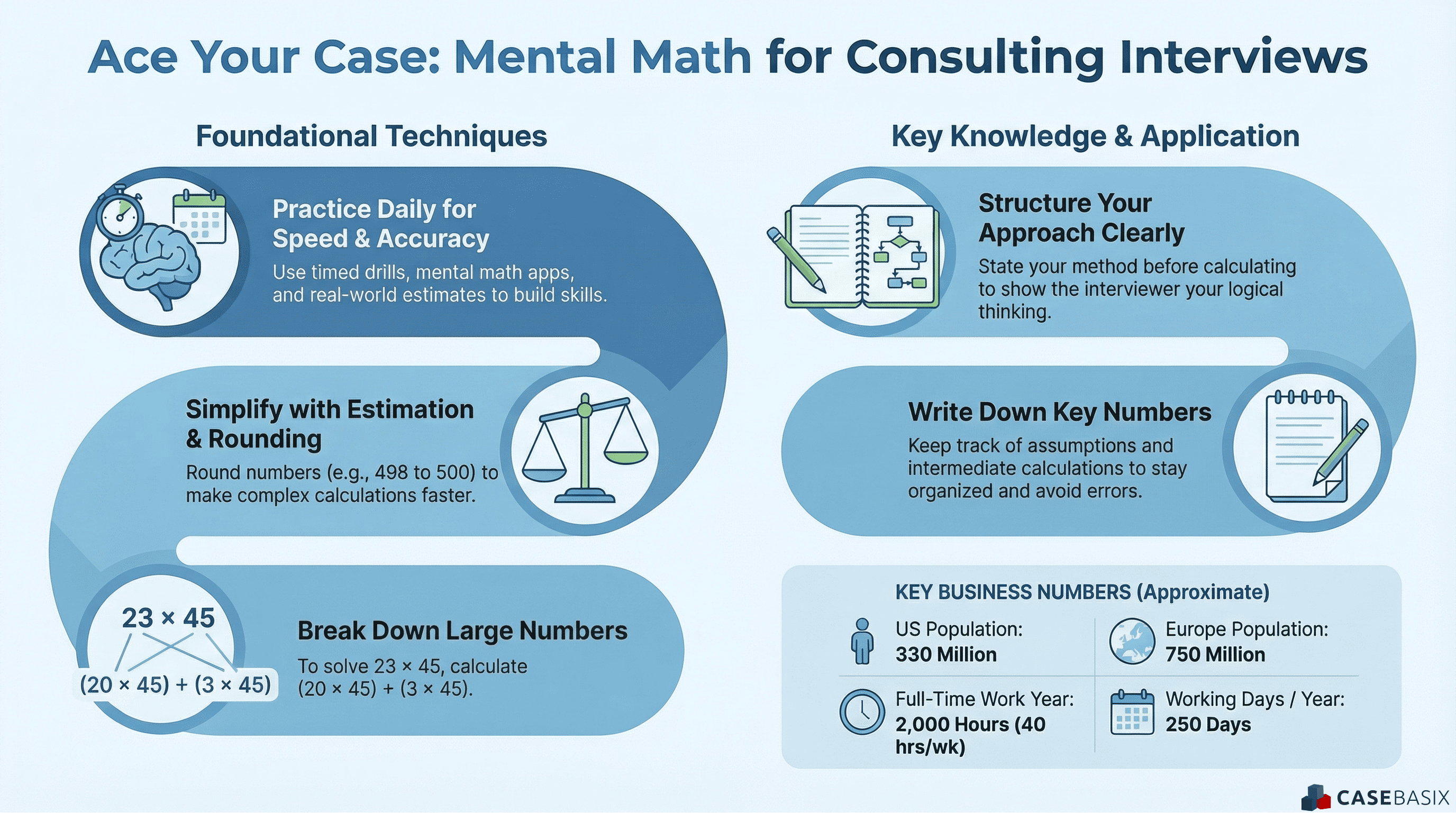

This infographic outlines practical mental math methods that help you stay accurate and structured during consulting case interviews.

Strong mental math skills make breakeven analysis faster and clearer during case interviews. Techniques such as breaking down large numbers and rounding help simplify complex calculations and reduce errors. Using structured steps allows you to communicate your reasoning while staying accurate under pressure.

Now that you’ve got a solid understanding of the components of breakeven analysis, it’s time to calculate the breakeven point. This is the magic number, the point where your total revenue equals your total costs, meaning you're covering all expenses but not yet turning a profit. Let’s walk through the formula and a simple calculation so you can apply this in case interviews with confidence.

Breakeven Formula

Here’s the formula for calculating the breakeven point:

Breakeven Point = (Selling Price per Unit − Variable Cost per Unit) / Fixed Costs

To break it down:

- Fixed Costs: These are the costs that stay the same, no matter how much you produce. Think rent, salaries, and insurance.

- Selling Price per Unit: This is how much you charge for each product.

- Variable Cost per Unit: These costs change based on production, such as materials and direct labor.

The formula tells you how many units you need to sell to cover your fixed costs. Once you hit this number, you’ve broken even. Anything beyond that is profit!

Calculation Steps

Let’s go through an example to make sure the formula clicks for you.

- Identify Fixed Costs: First, figure out your fixed costs. For this example, let’s say your fixed costs are $10,000 a month (this includes things like rent and employee salaries).

- Set the Selling Price per Unit: Next, figure out how much you’re charging for your product. In this case, let’s say you’re selling it for $50 per unit.

- Determine Variable Costs per Unit: Now, calculate the cost to produce one unit. For our example, let’s say it costs $20 to make one unit, including raw materials and labor.

- Apply the Formula: Now, let’s plug the numbers into the formula:

Breakeven Point = 10,000 / (50−20) = 10,000 / 30 = 334 units

This means you need to sell 334 units to cover your fixed costs and start making a profit.

Interpreting the Results

Once you’ve calculated the breakeven point, you can really start thinking about the business’s financial health. If you sell fewer than 334 units, you’ll be in the red. But if you sell more than 334 units, you’re in the clear and making a profit. This insight helps you assess pricing strategies, production costs, and overall business sustainability. It's a great tool for making decisions that drive financial success.

What Are Common Breakeven Analysis Mistakes in Case Interviews?

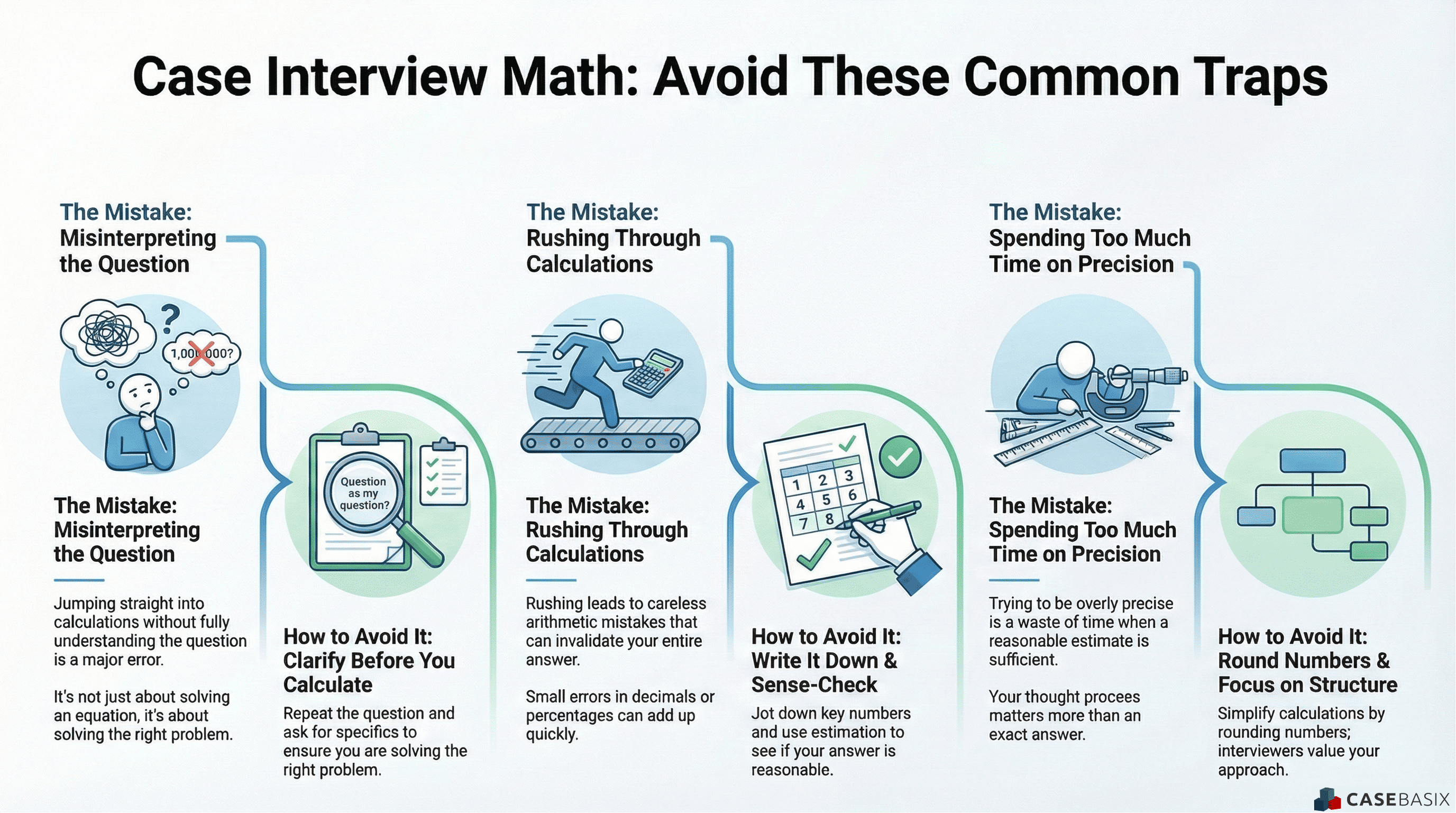

This infographic highlights frequent math traps in case interviews and shows how structured thinking helps you avoid them.

Avoiding common math mistakes is essential for accurate breakeven analysis during case interviews. Misreading the question or rushing calculations can lead to faulty conclusions even when your structure is sound. By using estimation, writing down key numbers, and staying focused on the core problem, you improve clarity and reduce errors.

Breakeven analysis is a valuable tool, but like any analytical method, it’s easy to make mistakes that can throw off your results. Let’s take a look at some common pitfalls you’ll want to avoid, so you can perform a more accurate analysis and confidently tackle case interview questions.

Overlooking Costs

One of the biggest mistakes you can make is overlooking certain costs. It's easy to focus on the direct costs of production, but there are always other fixed and variable costs to consider, like rent, utilities, or even marketing expenses. If you forget to include these, your breakeven point might look way more achievable than it really is.

To avoid this, make sure you’re considering every cost involved in running the business. In case interviews, you want to be thorough and ensure nothing is left out, this shows you’re paying attention to the details and thinking critically about the whole picture.

Misclassifying Costs

Another pitfall to watch out for is misclassifying fixed and variable costs. This can happen if you mistakenly treat a cost that’s actually fixed (like rent) as variable, or confuse a cost that changes with production (like labor or raw materials) as fixed. This can seriously skew your analysis and make the business look either more profitable or less risky than it actually is.

Take your time to correctly categorize costs. Fixed costs are consistent, no matter how much you produce (e.g., rent), while variable costs fluctuate with production levels (e.g., materials or labor). Getting this right is essential for calculating an accurate breakeven point.

Ignoring Market Dynamics

While breakeven analysis focuses on costs and sales, it doesn’t consider market dynamics, such as demand fluctuations, competitor pricing, or changes in the economy. If you ignore these external factors, you might miss how they can influence the breakeven point. For instance, if there’s a sudden drop in demand, you might find that reaching your breakeven point becomes much harder than the numbers suggest.

In case interviews, it’s important to remember that breakeven analysis is just one part of the puzzle. By considering the broader market context, you show that you can think strategically about the real-world challenges businesses face.

What Advanced Breakeven Analysis Examples Apply in Case Interviews?

Now that you’ve got a solid understanding of breakeven analysis, let’s dive into two advanced concepts that can give you deeper insights into a business’s financial health and risk: margin of safety and sensitivity analysis. These tools help you understand how much wiggle room a business has and how small changes can have a big impact on profitability.

Margin of Safety

The margin of safety is a measure of how much sales can drop before a business hits its breakeven point. Think of it as a financial cushion that shows how much room the company has before it starts losing money. The larger the margin of safety, the less risky the business is, because it can handle a decrease in sales and still stay profitable.

Here’s the formula to calculate it:

Margin of Safety = (Actual Sales−Breakeven Sales) / Actual Sales

For example, if a business is generating $100,000 in sales and needs $75,000 to break even, the margin of safety is 25%. This means the business can afford to lose 25% of its sales before it starts operating at a loss.

In case interviews, knowing the margin of safety helps you assess how much risk a business can handle. This is especially useful when evaluating new strategies, like cutting prices or entering a competitive market, and helps you think about the financial cushion the company has.

Sensitivity Analysis

Sensitivity analysis is all about understanding how changes in key factors, like the selling price, variable costs, or fixed costs, affect the breakeven point. It helps you see how small changes in these variables can impact the business’s profitability and breakeven target.

For instance, if you increase the selling price, sensitivity analysis will show how many fewer units you need to sell to break even. On the flip side, if your variable costs go up (let’s say material prices increase), sensitivity analysis will reveal how many more units you’ll need to sell to cover those costs.

In case interviews, sensitivity analysis helps you evaluate different business scenarios and their impact on the breakeven point. It’s a great way to show interviewers that you’re not just focused on the numbers but also considering how changes in the business environment could affect the company's financial position.

How Is Breakeven Analysis Used in Consulting Case Interviews?

Breakeven analysis is a key tool in many consulting case interviews. It helps you assess whether a business strategy or decision is financially viable. In this section, we’ll walk you through some typical case interview scenarios where breakeven analysis comes into play, how to approach these questions methodically and provide a sample case study to give you a clear understanding of how to apply this concept.

Typical Scenarios

In case interviews, breakeven analysis is commonly used to evaluate whether a business decision or strategy will lead to profitability. Here are a few typical scenarios you might encounter:

- Product Launch: You could be asked to determine if launching a new product is financially feasible. You'll need to calculate how many units must be sold to cover production, marketing, and other fixed costs.

- Pricing Strategy: You may need to evaluate how adjusting the price of a product will affect the breakeven point and overall profitability.

- Market Entry: In some cases, you’ll be asked to assess whether expanding into a new market is financially viable, based on expected sales and the costs involved.

- Cost Reduction: You might be asked how reducing specific costs, such as production or shipping, could impact the breakeven point and the company’s profitability.

Each of these scenarios will require you to apply breakeven analysis to evaluate whether the business can reach profitability and if the proposed strategy makes sense financially.

Approach and Strategy

When tackling break-even analysis questions in case interviews, it’s important to approach them methodically. Here’s a step-by-step strategy to help guide you through:

- Clarify the Problem: Understand the key challenge. Are you assessing a product launch, adjusting pricing, or evaluating market entry? Make sure you know what decision the company needs to make.

- Identify the Key Variables: Gather the data you need. What are the fixed costs, variable costs, and selling price per unit? If some numbers are missing, use reasonable assumptions to move forward.

- Use the Breakeven Formula: Plug the numbers into the breakeven formula, Breakeven Point (in units) = Fixed Costs / (Selling Price per Unit−Variable Cost per Unit)

- Analyze the Results: Once you have the breakeven point, ask yourself whether it’s achievable. Consider market size, demand, and pricing strategy. Is the breakeven point realistic based on the scenario?

- Consider Sensitivity: If you have time, explore how changes in key variables (price, costs, or sales volume) would impact the breakeven point. This will help you better understand the financial risks and reward potential.

- Communicate Your Findings: Clearly explain your assumptions, calculations, and the insights you’ve gained. Be sure to discuss how changes in the market or pricing could affect profitability.

Sample Case Study

Let’s walk through a sample case study to see how you would apply break-even analysis in a real case interview scenario.

Scenario: A company is considering launching a new gadget. The production cost per unit is $15, and the selling price is $50. The fixed costs (including marketing, salaries, and overhead) are estimated at $200,000. The company wants to know how many units it needs to sell to break even.

Step 1: Clarify the Information

- Selling price per unit = $50

- Variable cost per unit = $15

- Fixed costs = $200,000

Step 2: Apply the Formula

Breakeven Point = (200,000) / (50−15) = 200,000 / 35 ≈ 5,714 units

Step 3: Analyze the Results

The company would need to sell approximately 5,714 units to break even.

Step 4: Consider the Market Context

If the target market is small, 5,714 units might be hard to sell. However, if demand is high, this could be more achievable.

Step 5: Sensitivity Analysis

If the company is considering lowering the price to $45, here’s the new breakeven point:

New Breakeven Point = 200,000 / (45−15) = 200,000 / 30 = 6,667 units

By lowering the price, the company needs to sell more units to break even, showing how pricing decisions directly affect profitability.

What Are Final Breakeven Analysis Tips for Case Interviews?

Here are a few tips to help you master breakeven analysis and perform confidently in your case interviews:

- Practice Often: The more cases you tackle, the more comfortable you’ll become with identifying key variables and applying the breakeven formula. Keep practicing to build your confidence.

- Be Thorough: Don’t skip over the details, make sure you’re accounting for every cost, both fixed and variable. A solid analysis comes from being as comprehensive as possible.

- Clarify Assumptions: If you need to make assumptions due to missing information, always be clear about them. Explain why you’re making those assumptions and how they might impact your results.

- Look Beyond the Numbers: While breakeven analysis is about the numbers, you also need to consider the bigger picture. Factors like market demand, competition, and pricing strategy can all influence your breakeven point.

- Stay Calm and Structured: Case interviews can be high-pressure situations, but staying methodical and keeping your thoughts organized will help you shine. Take a deep breath, follow your process, and communicate your reasoning clearly.

With these tips in mind, you’ll be well-prepared to approach breakeven analysis with confidence. This skill not only helps you evaluate financial feasibility but also shows you’re capable of making strategic, data-driven decisions, something every consultant needs.

Frequently Asked Questions

Q: What is breakeven analysis in case interviews?

A: In case interviews, breakeven analysis helps assess when a business’s revenue will cover its fixed and variable costs, determining whether a strategy is financially feasible.

Q: How do you calculate the breakeven point in a case interview?

A: To calculate the breakeven point in a case interview, use the formula: Fixed Costs ÷ (Selling Price per Unit - Variable Costs per Unit), which tells you how many units need to be sold to cover all costs.

Q: What are common mistakes in breakeven analysis for case interviews?

A: Common mistakes in breakeven analysis for case interviews include miscalculating fixed or variable costs, overlooking the impact of the margin of safety, and not accounting for changes in selling price.

Q: How do you use breakeven analysis in consulting case interviews?

A: Breakeven analysis in consulting case interviews helps assess the profitability of a business model by identifying the number of units that need to be sold to cover fixed and variable costs.

Q: What is the role of sensitivity analysis in breakeven analysis for case interviews?

A: Sensitivity analysis in breakeven analysis for case interviews evaluates how changes in fixed costs, variable costs, or selling price affect the breakeven point, helping to understand potential risks.